Planned Giving

Since 1978, Casa de Amparo has been helping San Diego’s abused and neglected children heal and grow thanks to generous donors like you. Your planned gift will help us to continue the important work of making San Diego a community where child abuse is simply not tolerated.

Please consult with your tax accountant or your financial advisor to analyze which of the plans is most appropriate for you. We can also arrange a face-to-face meeting with you, your advisor, and Casa de Amparo’s Director of Development to discuss gift-giving options. Below is more information on how specific types of gifts can not only benefit Casa de Amparo but you as well!

For more information or to request a private tour of the Casa de Amparo programs, please contact Kathy Karpe at 760-566-3556.

The easiest way for you to build a legacy within Casa de Amparo is to name Casa de Amparo in your will and determine the amount of your gift. If you do name Casa de Amparo in your will be sure to let us know! We will be able to recognize you in our Legacy Circle and you will become part of a special group of like-minded donors dedicated to ending child abuse and neglect.

A Donor-Advised Fund (DAF) is a simple and efficient way to leave a legacy of generosity by helping Casa de Amparo. By establishing such a fund, you can time the gift you make (for investment or tax reasons) and you can select Casa de Amparo to benefit from your gifts. You receive the income or estate tax deduction, and the opportunity is there to make distribution decisions over time. You can also set it up so that your children or friends supervise the charitable gifts from their fund for years to come, which is a great way to encourage children to be involved in philanthropy.

A charitable gift annuity involves a contract between you and Casa de Amparo, whereby you transfer cash or property to the charity in exchange for a partial tax deduction and a lifetime stream of annual income. Many of our donors, especially those age 70 and above, are very interested in fixed payments for life from a charitable gift annuity. For a married couple, the payments will last until both have passed away.

A Charitable Remainder Trust is a qualified trust that pays income to Casa de Amparo. After all income payments have been completed, the remainder is distributed to Casa de Amparo. The person who establishes the trust may select the trust percentage or annuity amount, the person to receive the income from the trust, and the charities that will receive the principal of the trust after all income payments are completed. The major benefits of the trust are (i) Bypass of Capital Gains Tax, (ii) Increased Income and (iii) a Charitable Income Tax Deduction.

Another option that you may prefer is to leave property or money in an endowment so that Casa de Amparo does not spend the principal. Instead, Casa de Amparo grants the endowment income (as the donors often have done throughout their lives) per your instructions. It is helpful to suggest a general purpose for the endowment fund because it will last perpetually, and the original purpose for the gift may not exist in the future.

Gifting a life insurance policy allows you to make a significant legacy gift to Casa de Amparo with tax benefits that you can enjoy during your lifetime. As is the case with many retirees with grown children, you may not need a life insurance policy as a financial safety net anymore. Through a relatively small annual cost of the premium, you can give a gift to Casa de Amparo that is larger than otherwise would be possible.

A retirement plan can be a tax-efficient and simple way of including Casa de Amparo in your estate plan. The tax advantage stems from the fact that most retirement plans are subject to income taxes, and possibly estate taxes, if left to an individual beneficiary. However, if Casa de Amparo is named as the beneficiary, they do not pay income or estate taxes on the distribution.

If you own a family business, substantial real estate holdings, or a large estate, then a custom plan that considers your special property goals and requirements can be created.

Join our Legacy Circle

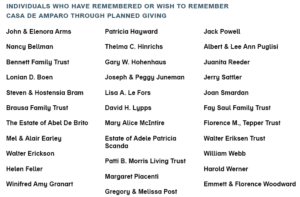

By making a planned gift of any type you will become part of our Legacy Circle! As part of our Legacy Circle you will be a part of a community of like-minded donors who are dedicated to end child abuse and neglect as well as build a lasting legacy for Casa de Amparo for years to come.

Your name will also be listed in our Annual Report as well as here on our website!